Salary deduction percentage

Employees Hired Between January 1 2013 and December 31 2013. In the Ontario tax deductions table the provincial tax deduction for 615.

Payroll Journal Entries Journal Entries Payroll Journal

For recovering advances loans overpaid salary or unearned employment benefits.

. In the interim budget of 2019 the total limit of standard deduction under income tax has been increased to Rs. Some states follow the federal tax. It should also not exceed 25 of your salary for the salary period.

However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Your employer can take 10 of your gross earnings which is 25. They must only take 25 one week and then make another deduction from your next pay.

The current rate for. The state tax year is also 12 months but it differs from state to state. The money also grows tax-free so that you only pay income tax when you.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Employees hired during the 2013 calendar year typically contribute 31 percent of their salary to the.

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. Social Security and Medicare Withholding Rates. Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. For advances your employer can deduct. This raised the tax from 145 percent to 234 percent for people with an earned annual income of more than 200000 250000 for married couples filing jointly.

Maximum earnings subject to Social Security taxes increased by 4200. Salary deduction refers to the amount withheld by an employer from an employees earnings. Youre paid 250 gross per week.

Section 80C 80CCD 1 and 80CCC. This makes your total taxable. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages.

According to the Employment Acts Section 24 1 no deductions shall be made by an. That includes overtime bonuses commissions. To determine Saras provincial tax deductions you use the weekly provincial tax deductions table.

Consumer Credit Application Form Lovely 15 Application Form Templates Free Sample Example Application Form Job Application Form Templates

Pf Deduction Pay Head For Employees Payroll In Tally Erp 9 Data Migration Deduction Data

5 Of 12 The Logical Fallacies Collection 30 Ways To Lose An Argument 9 Bandwagon Claiming Logic And Critical Thinking Fallacy Examples Logical Fallacies

Proportional Non Proportional Linear Relationships W Google Distance Learning Linear Relationships Math Tutoring Activities Maths Activities Middle School

Download Salary Arrears Calculator Excel Template Exceldatapro Excel Templates Excel Salary

Free Equipment Bill Of Lading Template Example Promissory Note Notes Template Student Encouragement

How Much Did I Make Driving For Lyft Uber On A Saturday Night In The Oc La Rideshare Lyft Lyft Driver

Printable Sample Promissory Note Form Form Doctors Note Doctors Note Template Notes Template

Pin By Brian Dufort On Classroom Ideas Bay City Midland The Unit

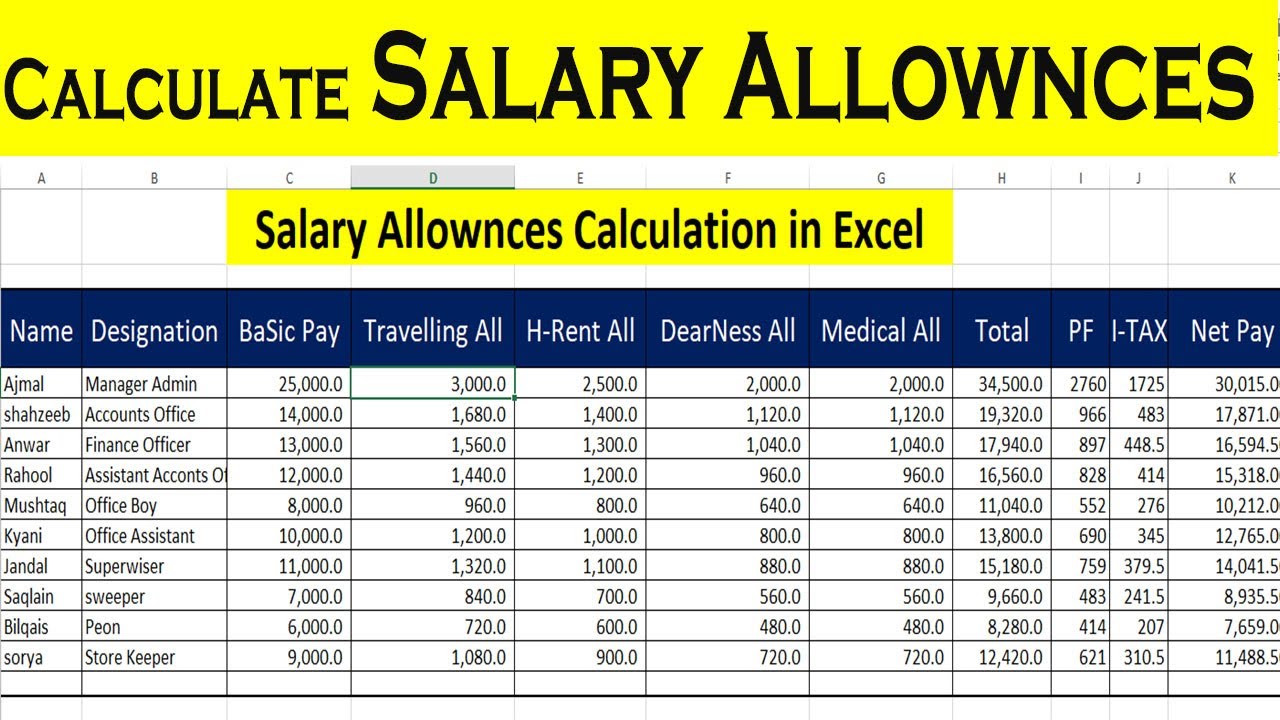

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Learning Centers Tax Deductions Excel

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Business Template

Solving Equations W One Variable On Both Sides Of Equal Sign Stations Solving Equations Math Lessons Middle School Middle School Math

Proportional Non Proportional Linear Relationships Equations Tables Graphs

Max Out Retirement Plan Contributions Whether It S A Traditional 401 K A Roth 401 K Or A Simple Ira A Salary Defer Simple Ira How To Plan Retirement Planning

Careers Salaries Tax Percentage Deduction Income W Google Distance Learning

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

Payroll Deduction Authorization Form Template New 10 Payroll Deduction Forms To Download Payroll Payroll Template Deduction

Komentar

Posting Komentar